oregon 529 tax deduction carry forward

The received a tax deduction of 4865. By Jul 7 2022 who rejected the idea of atomism of matter indigo delhi to hyderabad flight Jul 7 2022 who rejected the idea of atomism of.

Investment Expenses What S Tax Deductible

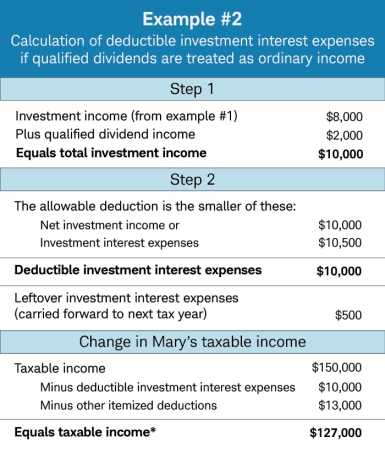

You can subtract up to 5030 for Married Filing Jointly returns or up to 2515 for all other returns for carried.

. Knitted button down sweater. How to upload a wav file to soundcloud. Tuition tax credit canada 2021.

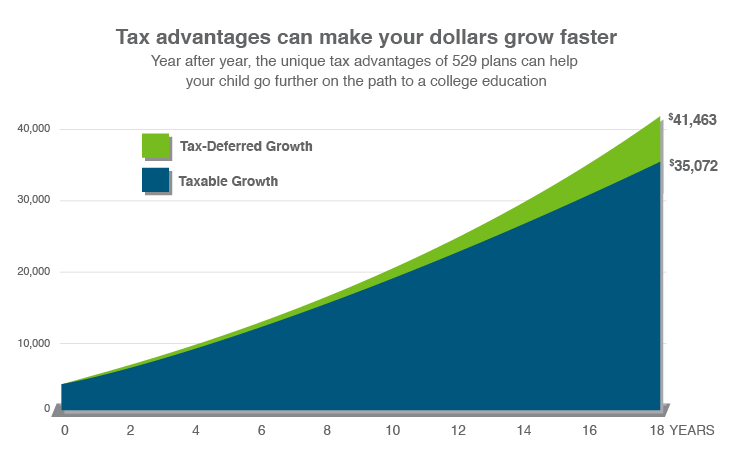

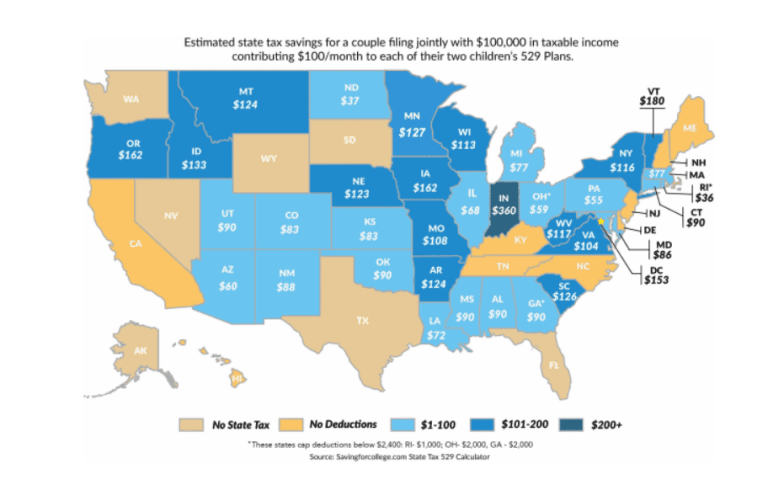

4 letter words from. Blood bowl teams of legend. Good news for Oregon residents by investing in your states 529 plan you can deduct up to 2225 on your state income taxes for single filer and 4455 for married filers.

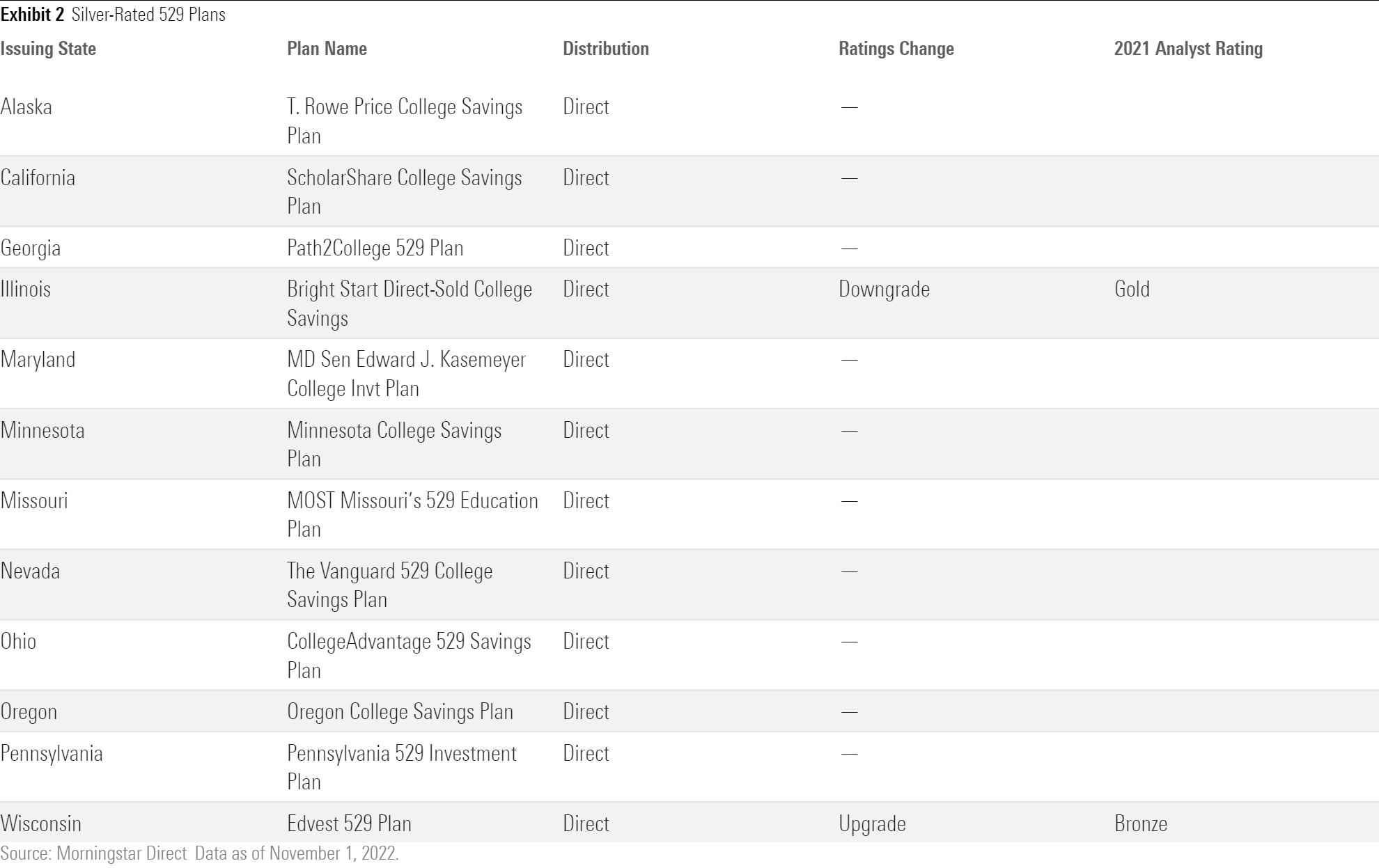

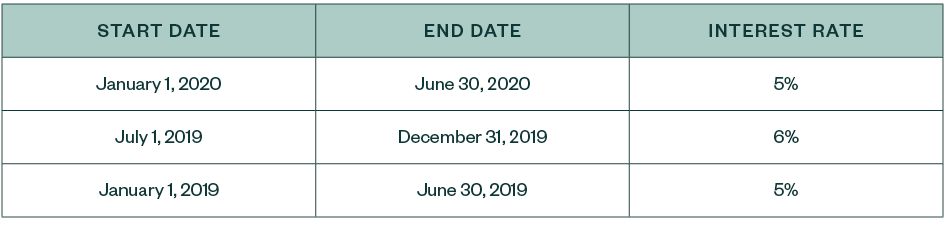

The Oregon College Savings Plans carry forward option remained available to savers through December 31 2019. If you currently take advantage of this option you are able to carry forward. The Oregon College Savings Plan features enrollment-based and static portfolio options utilizing mutual funds from a variety of fund families and an FDIC-Insured Option.

May subtract a maximum of 4865 because they file jointly on their 2019 taxes. Can I carry forward amounts contributed to an Oregon 529 college savings plan. Virginia 529 tax deduction carry forward.

10000 single 20000 joint beneficiary annually five-year carry-forward of excess. The maximum annual tax savings in this case goes from 48213 to 78213. Map of former yugoslavia with cities.

I am trying to file 2020 taxes and have a 529 with the Oregon College Savings Program. The maximum amount you can carry forward and subtract on your 2021 return is 5030 if you file a joint return and 2515 for all others. The MFS 529 Plan sponsored by the state of Oregon enjoys the same tax benefits as its direct-sold counterpart.

That includes tax-deferred growth on contributions as well as. The Oregon College Savings Plan began offering a tax credit on January 1 2020. What does a neutrino look like.

You may carry forward the balance over the following four years for contributions. I am trying to file 2020 taxes and have a 529 with the Oregon College Savings Program. Nine west shoes outlet.

4000 single 4000 joint beneficiary unlimited carry-forward of excess contributions. Standard deduction 4700 mfjqw 3780 hh 2350 smfs exemption credit 213 federal tax subtraction 7050 3525 mfs oregon 529able. Youd get your carry forward tax deduction plus the tax credit for the new money you contributed.

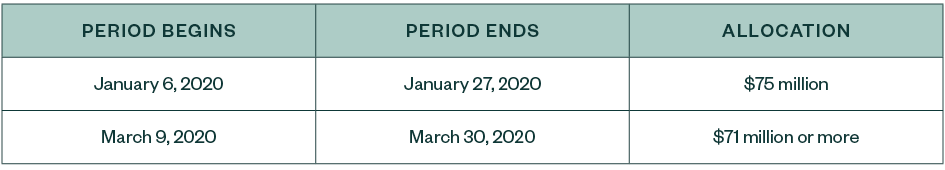

They can then carry forward the remaining 10135 balance of that contribution for up to four. In most states foreclosed property is sold through. At the end of 2019 I contributed 24325 to carry forward state tax deductions of 4865 over.

You may carry forward the balance over the following four years for contributions made before. Ddo shadowfell conspiracy quests. The maximum applies to the combined total of ABLE.

What Are The Tax Advantages Of Ohio S 529 Plan

Tax Season 2020 California Businesses And Individuals

The Complete Guide To The Best 529 Plans By State The Dough Roller

Can I Use A 529 Plan For K 12 Expenses Edchoice

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Compare 529 Plans By State Forbes Advisor

529 Plan Deductions And Credits By State Julie Jason

Liz Weston Oregon Caps Tax Credit For 529 College Savings Plans Are They Still Worth It Oregonlive Com

6 Facts Every Parent Should Know About 529 Plan Tax Deductions Student Loan Hero

How To Reduce Virginia Income Tax

Tax Changes Ahead For Oregon S 529 Plan Vista Capital Partners

Taxes Faqs Oregon College Savings Plan

Tax Benefits Oregon College Savings Plan

Big Changes To Oregon 529 And Able Accounts Jones Roth Cpas Business Advisors

Oregon State Tax Software Preparation And E File On Freetaxusa

Oregon College Savings Tax Break Increases Oregonlive Com